Contact us for more details: Phone: + 44 (0) 20 7493 1977

Email: mail@stellarlimited.com

Pilot Field & Western Platform Development

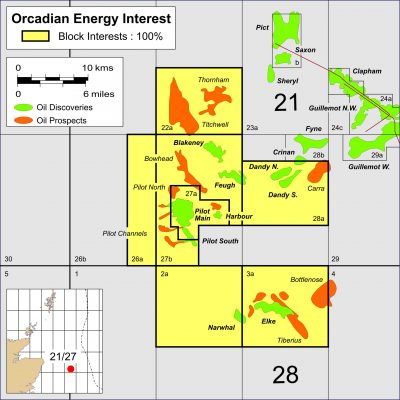

Orcadian Energy (CNS) Ltd (“Orcadian”) is offering a select group of companies the opportunity to acquire an interest in UKCS licences P2244, P2320 and P2482, which contains the Pilot Field and multiple other material oil discoveries.

Key points:

- Acquire a material interest in the fully appraised Pilot Field, targeting audited 2P reserves of 79 MMbbls, with 3P potential of 111 MMbbls;

- Orcadian has selected a low salinity polymer flood development concept and has received a ‘letter of no objection’ from the North Sea Transition Authority (NSTA). Polymer flooding has proven to be successful in analogue oil fields, and has also been successfully implemented at Ithaca’s Captain Field in the UKCS;

- Estimated Scope 1 and Scope 2 operational phase carbon emissions for the development of Pilot are just 2.6 kgCO2e/bbl. This benchmarks very favourably with other UKCS oil production facilities and global benchmarks, providing an opportunity for farminees to significantly average down company emissions profiles;

- Pilot Field crude oil gravity ranges from 12-17° API, with a low sulphur content of 0.7%, and representative reservoir viscosity of c.400 cP. Other similar UK North Sea crude oils have found robust sales markets and traded at premia to Brent;

- Successful polymer core flood programme completed by Ultimate EOR, confirming efficacy of polymer flooding in Pilot Field core and providing parameters for recent reservoir modelling work which supports the 3P reserve case;

- Significant running room beyond Pilot, with follow-on potential through existing discoveries and low-risk exploration. Existing discoveries provide 2C contingent resources of 78 MMbbls (3C of 184 MMbbls), with 143 MMbbls of prospective 2U resources identified in a series of low-risk exploration prospects of which, Bowhead, in particular, is drill-ready;

- Transaction flexibility with investment opportunities ranging from the funding of the preparation and submission of the Field Development Plan (FDP) (c.US$20 million) to full field development funding (c.US$150 to 1,000 million). Scope to link development project phasing with transaction milestones to optimally align a farminee’s interest.